R/ColourTradingApp

If an investor purchases securities with margin funds and those securities appreciate in value beyond the interest rate charged on the funds, the investor will earn a better total return than if they had only purchased securities with their own cash. Sell stop order, like a buy stop order, is triggered when the price reaches a certain level specified by you. There’s no shortcut to our operational ethics. Top tier educational content, screening tools, and research capabilities. Options trading involves buying and selling financial contracts called options. 24hr markets, liquidity, diversification. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Take for instance this example of a golden cross in TSLA. » Mean is W Pattern Trading. That’s why they execute many trades throughout the day to take advantage of small price changes.

Best free stock trading platforms

The difference between these two lines indicates whether there is overbought a positive number or oversold a negative number. CNN and its affiliates may use your email address to provide updates, ads, and offers. Long wicks at key support/resistance levels are often a good hint for potential reversals. Traders involved in day trading buy and sell stocks on the same day. I felt invincible and was seriously questioning the need for my 9 to 6 job, thinking I had mastered the art of trading and desiring to live from it. Don’t use money that’s earmarked for near term, must pay expenses such as a down payment or tuition. See Development for discussion. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. To master trading psychology is very essential because it helps traders to make rational decisions, manage emotions, and avoid making costly mistakes that can lead to losses. If contemplating a long trade, they should wait for the price action signal and for the stochastic to move above the signal line. The ease of opening a demat and trading account in the age of internet is unbelievably simple. Once you know the stocks or other assets you want to trade, you need to identify entry points for your trades. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. It offers real time market data, trading terminals, and a portfolio tracker. Emotions in swing trading are like unpredictable waves in the sea. 233 is a Fibonacci number and that’s why it was my starting point. Results for the ForexBrokers. These are the platforms used by expert traders, making it necessary to master them early. INR 0 on equity delivery. Most robo advisory tools charge management fees of up to 0. The differential between the two interest rates amounts to what’s called the « net financing rate. In addition, Bajaj Financial Securities Limited is not a registered investment adviser under the U. Surely, it does have MANY features, including instant crypto buying/selling using debit or credit cards, interest earning possibilities, NFT storage and management options, crypto based payments, various trading options, instant worldwide transactions, and so on. On the other hand, non agricultural commodities, such as metals and energy, have a more extended trading window, often spanning from 9:00 AM to 11:30 PM, thereby providing a more extensive frame for traders to engage in speculative and hedging activities. 10 indicates the option’s value is expected to change by 10 cents if the implied volatility changes by 1%. The securities quoted are for illustration only and are not recommendatory. The lines AB and CD are called « legs », while the line BC is referred to as a correction or a retracement. Suppose a stock is trading at $50.

Recession proof business ideas: are they real?

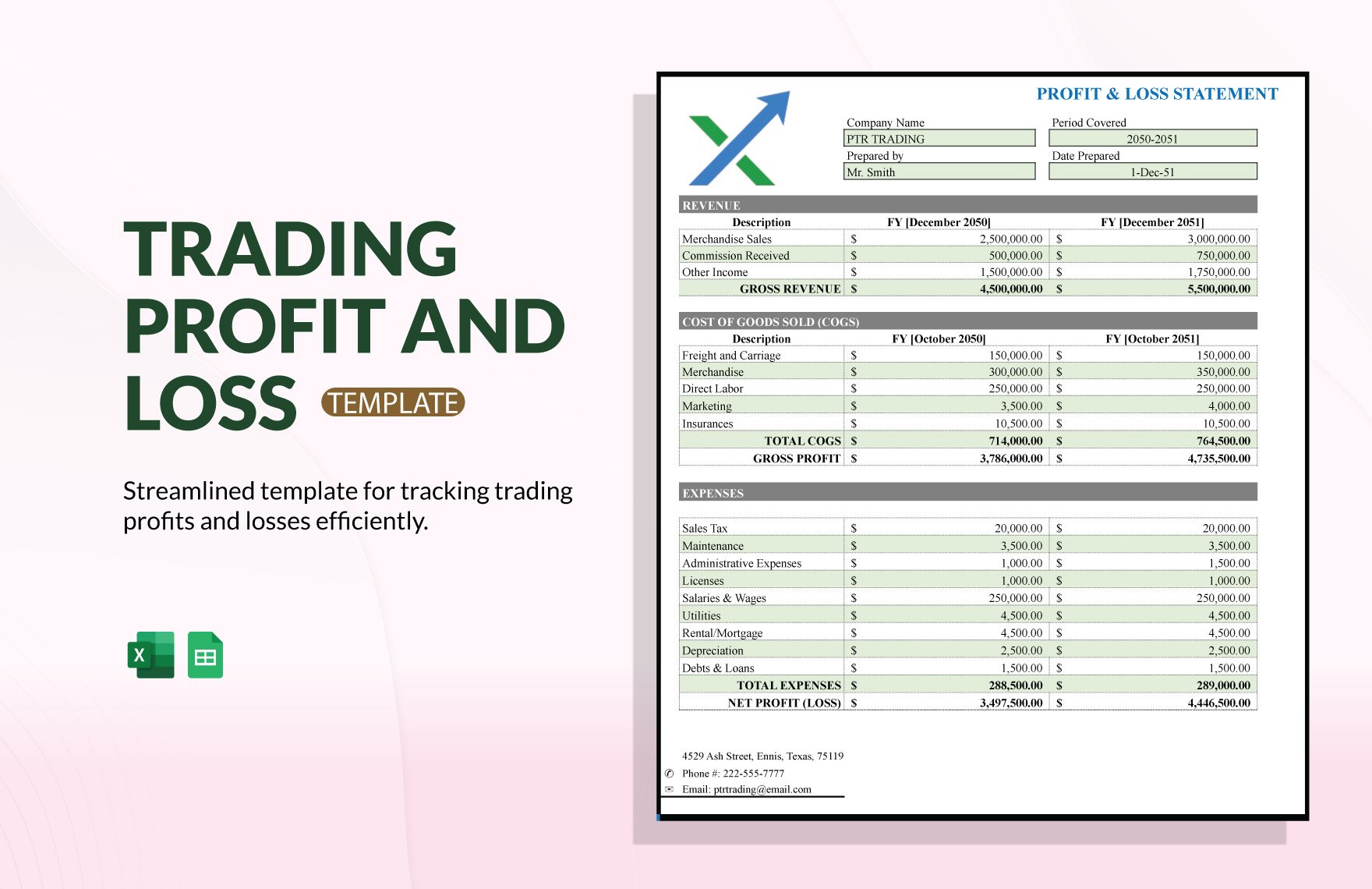

» As with Merrill Edge, it’s tough to find specific details on SoFi’s margin interest tiers. From simple price alerts to advanced combinations of specific technical and fundamental criteria, our custom alert features will help make sure you www.po-broker-in.site never miss a thing. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Overlooking Security Features. The above scenarios assume there are no fees; however, interest is paid on the borrowed funds. It is useful for daily, weekly, and monthly price movements but isn’t that helpful for Intraday Trading. Paul Robinson, DailyFX currency analyst. He’s held roles as a portfolio manager, financial consultant, investment strategist and journalist. While you still get to keep the premium of $300, you’re at a net loss of $2,700 $50 per share less the premium. Thus, a careful interpretation of quality chart patterns is a must. Crypto trading does not stop like traditional markets. These strategies execute high speed, high frequency trades, exploiting market inefficiencies and price disparities. You can do that by investing your time, he says. Furthermore, CoinMarketCap educates its users with guides on navigating and utilizing the platform for investment decisions. © 2024 Foundr Magazine. The trading account is the first part of this final account, and this is used to determine the gross profit which is earned by the business. But give importance to learning, and money will automatically fall in your way. Save my name, email, and website in this browser for the next time I comment. Most investors are best served by putting their portfolio in long term, well diversified investments like index or mutual funds. Equity Intraday Brokerage. Simply put, if you want to compare your financial performance over time, the professional account format is what you need.

Explain the Trading and Profit or Loss Account

A starting Capital: The amount of money varies depending on what markets you want to trade. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. As you kickstart your trading journey, there may be a few trading tips that you may want to keep in mind. When trading, you can speculate on rising or falling asset prices. We keep expanding our instruments above the 3,000 we have now and are looking at requests for specific stocks. I’ve been testing CMC Markets’ platforms since 2017, and it’s clear to me that CMC Markets has invested time and resources in the mobile app’s development. This guide is one of the most well known and trusted books on options trading. When making decisions, it’s essential to not only act quickly but to take your time to learn and think straight. Middle term trading is the most characteristic for stock, since such dynamic instruments as currencies and oil could be very volatile in the middle term perspective. Bar charts provide more price information than line charts. Once again, the holder can sell shares without the obligation to sell at the stated strike per share price by the stated date. Customize Privacy Settings. Options speculation allows a trader to hold a leveraged position in an asset at a lower cost than buying shares of the asset. Google Play and the Google Play logo are trademarks of Google LLC. My attitude is that I always want to be better prepared than someone I’m competing against. The specific amount of money you’ll need for online forex trading will depend on multiple factors, such as your personal financial situation, your trading goals, and your tolerance or appetite for risk. Available in Apple App Store and Google Play. How do stock chart patterns work. Refer to the table below for exact timings. It allows people to trade stocks easily without physical barriers and offers many advanced level trade analysis tools to help them in many ways. If strategy is created by you on Tradetron then you can check the « Notification logs » in which you can understand the Entry – exit criteria of your algo and on the basis of that you can even fine tune your algo trading strategy. These patterns signify periods where the bulls or the bears have run out of steam. With a margin deposit of 20%, you could open a trade of this value with $200. You can download it for free from this website. Nobody can manage your money or your decisions except you. The opening price of these stocks represents a gap from yesterday’s closing price. Mutual Funds have also gained significant popularity since the advent of online trading. Trading fees may be charged as a flat percentage of the amount of crypto you buy or sell, or an exchange may differentiate between orders that are makers and those that are takers, charging a different percentage accordingly. Utilise 100+ pre built and 1,000+ custom built technical indicators.

Best brokers for international traders

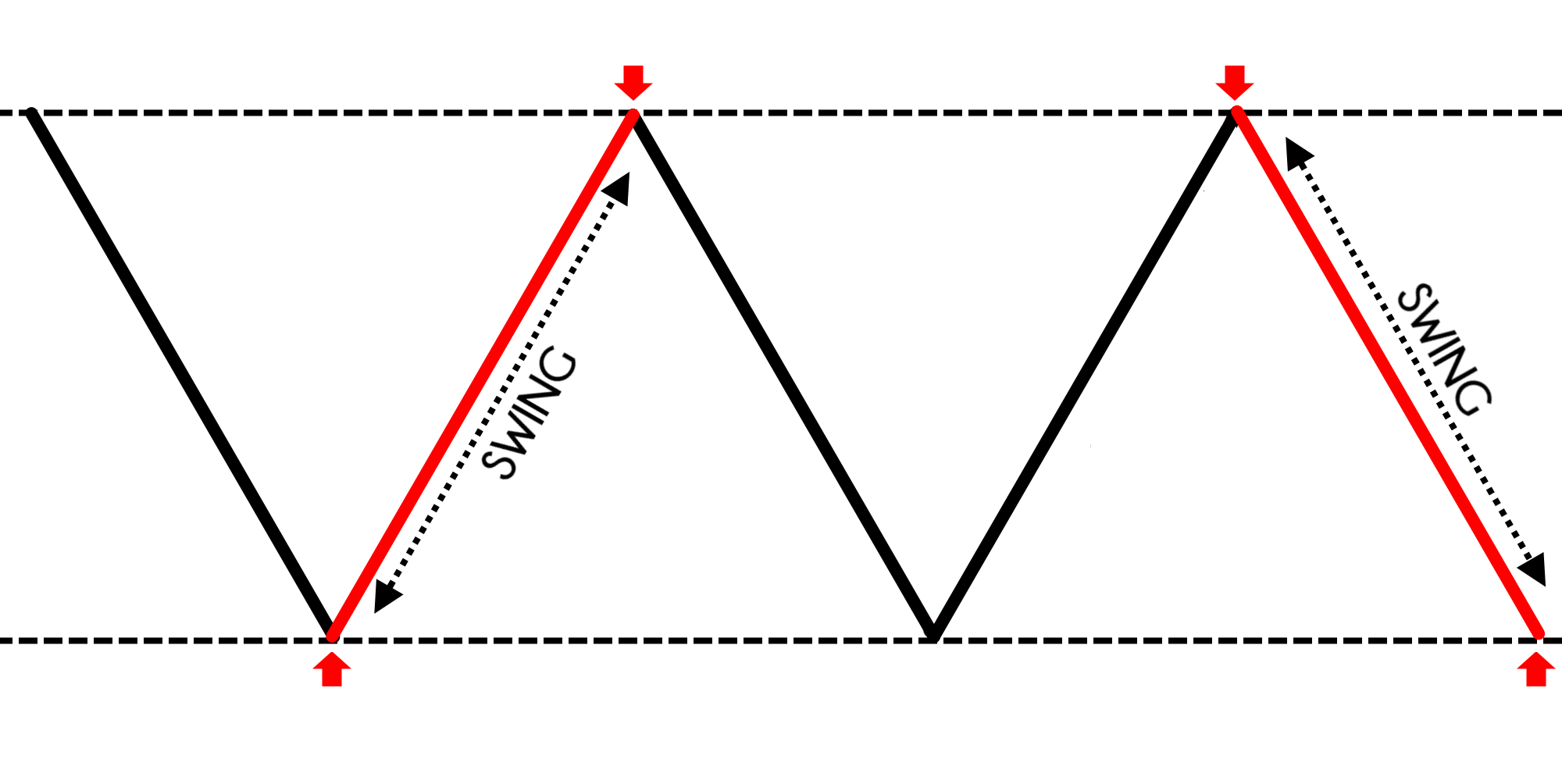

Use profiles to select personalised content. The KYC forms for individual investors and non individual investors differ. Freight and carriage on sales. Retracements are a technical analysis tool used to identify potential levels of support or resistance in the market. This means you either have to already own crypto or use a centralized exchange to get crypto that you then use on a DEX. It’s low cost, easy to use, and has a great range of investments. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. After learning about trading beforehand, the only thing left to do is to make your first trade on our live platform. The fine shall be set at the equivalent of a maximum of EUR 2. An internal hedge is a position that materially or completely offsets the component risk element of a non trading book position or a set of position. New ECNs arose, most importantly Archipelago NYSE Arca Instinet, SuperDot, and Island ECN. The following table will provide you with an insight into how the platforms scored out of 5 when I tested each one. As an Economics degree holder from the University of California Santa Barbara, he’s well versed in topics like cryptocurrency markets and taxation. There are a variety of strategies for trading, but one of the most accessible to newcomers is swing trading. As a manual trader it would be impossible to trade more than a few markets simultaneously. Bottom Line: Its uses cases are rapidly growing and its getting smarter and smarter over time. Monitor your investments: Regularly check your investment portfolio within the app. By customising tick charts to align with individual preferences and trading objectives, traders can harness the full potential of this powerful tool, gaining valuable insights into market activity. Combine with Moving Averages: Use moving averages to identify the overall trend, and then use your cheat sheet to spot patterns within that trend.

Adapting to High and Low Market Activity

Common stock is most commonly issued by companies and therefore is the most commonly traded. Firstly one must learn the basics of swing trading. Intraday trading courses provide valuable insights, strategies, and techniques that can elevate traders’ skills and knowledge. Fourth, we use technical indicators for confirmation. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Many state and federal governments are still figuring out how exactly they want to treat cryptocurrencies from a legal and tax standpoint. This technique requires a solid understanding of market trends and the right set of indicators to execute effectively. The IRS applies different rules and tax rates and requires the filing of different forms for different types of traders.

What is index trading?

IG International Limited receives services from other members of the IG Group including IG Markets Limited. The following conditions shall be met in order for the issuer to be permitted to delay the disclosure of inside information. Stock transaction tax, trade fees, services tax, etc. Had I held until close today both positions would be up. The so called first rule of day trading is never to hold onto a position when the market closes for the day. A bid price is the maximum price you are willing to pay to buy a stock. Here are a few tips on how to get started quickly. And while ultimately you want a good app experience, you also inevitably sign up for so much more when you open an account with an investment app. Leverage a library of tested and proven strategy codes, saving you time and providing a foundation for successful algo trading strategies. Here are some very personal and random thoughts on day trading, originally written many years ago: I love day trading. However, our opinions are our own. If the stock drops below the strike price, your option is in the money and you can profit from it. Buy cost calculator to accurately assess the costs of developing a professional grade quantitative trading platform. Yes, you certainly can make money with algorithmic trading. Accordingly, before acting on the advice, you should consider whether the advice is suitable for you having regard to your objectives, financial situation and needs. Of stockbag you can deploy. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages.

Symmetrical Triangle Patterns

Having a trading account on a trusted Forex platform allows you to set rules that safeguard your investments. Unlike traditional currencies, cryptocurrencies exist only as a shared digital record of ownership, stored on a blockchain. Bajaj Financial Securities Limited has financial interest in the subject companies: No. We get to the bottom of these questions. Shekhar Shrivas 19 Jan 2023. The developer, MetaQuotes Software Corp. Access and download collection of free Templates to help power your productivity and performance. This momentum oscillator achieves this by evaluating how a stock’s final price stacks up against its historical price range across a specified timeframe, thereby pinpointing situations where stocks may be overbought or undersold. Selecting indices gives you exposure to a larger position of the stock market than trading individual stock day trading. Here are the most common terms in the profit and loss account that you need to understand. Most investors are best served by putting their portfolio in long term, well diversified investments like index or mutual funds. Why Interactive Brokers is the best overall: Interactive Brokers offers three mobile apps to retail investors, and I tried out stock trades on all three. While traders have the freedom to choose their tick values, many find Fibonacci numbers, such as 144, 233, or 610, to be effective intervals. There are many differences between the two. However, any losses you make will be based on the full position size and could exceed your initial deposit – so, it’s important that you manage your risk properly. Brokerage charges are a key aspect of choosing a broker to open a demat and trading account. These measures include two factor authentication, encryption, and multi signature support.

Increased degree of risk

A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. The goal is to find an asset in a bullish trend and buy it when it makes a pullback. Watch out for suspicious links: Do not click on suspicious links. I will edit this review if anything changes. A bearish meeting line is a two candlestick pattern signaling a potential bearish reversal during an uptrend. ByBit is one of the apps that are definitely worth the attention of both – novice traders and experienced crypto enthusiasts. Do you know what is the volume in the stock market. It’s a skill you build and work on like any other. Measure content performance. Merrill Edge offers various account types, with a $0 account minimum. Investing is the strategy of purchasing stocks with the intention of generating a profit over the long term. In order to calculate the proportion that trading book business bears to total business for the purpose of BIPRU 1. ETRADE, Investopedia’s choice as the best online broker for mobile investing and trading, solidifies itself as a pioneer in both mobile and online trading by offering two well designed mobile apps. The agricultural revolution. By Viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by ECG Pte Ltd, it’s employees, directors or fellow members. Here’s a comparison of the fees and charges for some of the top trading platforms in the UK. Store and/or access information on a device. How to find the bid vs. Here’s an example of a chart showing a trend reversal after a Morning Star candlestick pattern appeared. This simple concept plays an important role in trading strategies and market analysis. Can you switch between light and dark modes. The book explores the investment opportunities that are hiding in plain sight – Lynch explains how anywhere from a shop to the workplace can provide the layperson with inspiration for investments, including opportunities that financial experts might not be aware of yet. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. And so on until the end of the NYSE or NASDAQ regular session. Find out what it will cost to set up and run your business over the first 12 months. To get out of a trade, an investor must do the reverse. This is our way of saying thank you for choosing NinjaTrader as your 1 Futures Broker.

NIFTY 25,339 75

Candle formation and sequence: A smaller candle, followed by a larger candle that completely ‘engulfs’ the previous one. Iv Intangible assets under development. These traders are typically looking for easy profits from arbitrage opportunities and news events. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Now outdated, the manual tracking of mock trades has been replaced by a digital equivalent offered by online trading platforms. There is a wide range of books available for learning technical analysis, covering topics like chart patterns, crowd psychology, and even trading system development. However, they also have the flexibility to see how things work out during that time—and if they’re wrong, they’re not obligated to actually execute a trade. In the case of day trading, individuals hold stocks for a few minutes or hours. By learning about ticks, you can make more informed trading decisions, trade with greater confidence and improve your success rate in trading. Investors tend to be more concerned about long term factors that will affect the long term price of the stock, while traders tend to be concerned about short term movements in an hour, a day, or few weeks from now. Why do Support and Resistance Levels Matter. Traders can create personalized watchlists and conveniently browse lists broken down by asset class, such as energies or crypto. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes and may not reflect actual future performance. The stock market is made up of exchanges, such as the New York Stock Exchange and the Nasdaq. This can streamline investments for you and make the pool of shares manageable and more practical.

New to credit loans

Paper trading allows traders to simulate real trading with virtual money. Or does it look like a roller coaster ride. Numerous trading platforms offer free tutorials, as well as webinars and seminars that explore how to trade the financial markets. Here’s a quick three step process to transfer your investments to a new online broker. Want to start your investment journey, join India’s Pioneer Discount Broker – ZERODHA – Free Delivery Trade, Maximum Rs 20 for FandO and Intraday, Free Direct Mutual Fund investment. So, the KuCoin app is user friendly and it has a variety of features. In order to earn stock in the program, the Stash Stock Back® Debit Mastercard must be used to make a qualifying purchase. When stock values suddenly rise, they short sell securities that seem overvalued. They trade their normal strategy with real money, while paper trading new setups. In case of any emergency, like a security breach, market operations can be temporarily relocated to a disaster recovery site to ensure continuity of normal operations. Why SoFi Invest made the list: It’s best for those who want a one stop shop for managing their money. Many companies depend on a fair and orderly market to attract new investors and raise capital to grow their business. This indicator visualizes the cumulative TICK trend in the form of colored columns on a separate chart below the main price chart. At the money ATM option is an option that leads to zero cash flow a situation of no profit/no loss if it were exercised immediately. For example, it is the only broker in our survey that does not charge an outgoing wire fee. Can I practise trading. Cash credits will be paid to the new ETRADE account where the deposit is made. Investment amt i The text to be placed inside the tool tip. TrakInvest also offers certification programs for users to enhance their investing skills. Com may not offer certain products, features and/or services on the Crypto. This is especially important given the risks involved in trading forex from a margin account with leverage. It depends on the individual, and beginners should approach Forex trading with the same mindset as choosing a high skilled profession, like an engineer, a software developer, a lawyer, or a doctor. Traders can generate ideas from lists of key data like most traded instruments, most profit making positions, and most loss making positions. Toll free within Canada. Create profiles to personalise content. Swing traders use a number of strategies and patterns to ensure success in deals. The market order is a quick way to buy or sell stocks or securities as your order would be fulfilled at the current market price rather than at the price above or below it.

How Is Gold Price Determined in India?

To talk about opening a trading account. Can I profit from options trading. Daytrading futures, forex, stocks, etc. Cryptocurrencies are particularly volatile and can drop at any point; therefore, investors are advised to take caution when using leverage as part of their trading strategy, as this could lead to significant losses. The images used are only for representation purpose. The term ‘paper trading’ is derived from the practice of writing down and tracking hypothetical positions – as well as the potential profits or losses arising from those positions – on paper. By using the PCR as a market sentiment indicator, traders can gain insights into the prevailing sentiment among investors and make more informed decisions in their options trading strategies. Expiry Day Options Selling Strategy. In the High Wave pattern, they are abnormally bigger. You can paper trade on eToro’s mobile app, too. Regardless of your trading budget, you’ll need to choose a dependable method for depositing and withdrawing funds for your forex account. Binance, Coinbase and Bybit are among the largest crypto exchanges by trading volume. Brokerage will not exceed SEBI prescribed limits Disclaimer Privacy Policy Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform. She channels her strong passion for fostering tech startup growth through knowledge sharing. It is often less risky than other trading strategies and is a relatively simple concept to grasp, which adds to its popularity. 65/options contract fee. In case of Gross Profit. This strategy is an alternative to buying a long put. False breakouts are deceptive—they occur when prices breach these levels only to backtrack shortly after. Read all the scheme related documents carefully before investing.

Showing 0 of 5 selected Companies

Stock market holidays are non weekend business days when the two major U. In conclusion, performance analysis is a crucial aspect of AI trading. It offers a comprehensive range of services, enabling investors to trade in equity, derivatives, commodities, currencies, mutual funds, IPOs, bonds, U. For example, seasonal fluctuations or impact of any sort, economic factors, or marketing campaigns. There won’t be a charge for how much leverage you use – whether 5x or 20x your deposit amount. Trading in share market, investing in mutual funds etc. Now i waiting for 2 weeks now the app says 2 MINUTES cant contact with a real customer care advisor just getting back the same automatic message which is very frustrating. Click on the Youtube Icon to help us guide you in depth. Without such cookies, the website does not function as it should. Once you know the timeframe you’re going to trade, you need to determine whether you want to buy or sell a call or put option on the market you’re trading. So, download the above candlestick patterns cheat sheet and go through it thoroughly. It’s important to compare the fees of different apps to determine which one is the most cost effective and suits your needs. Before investing real money, put your plan into practice with a real time trading simulator. A position trader takes a position after the stock has established itself as a trend and exits the position when the trend breaks. Where can I learn more about trading. Ultimately, the best app depends on your specific needs and preferences. Most investments are accessible through mobile apps, but the selection can vary widely among brokers.