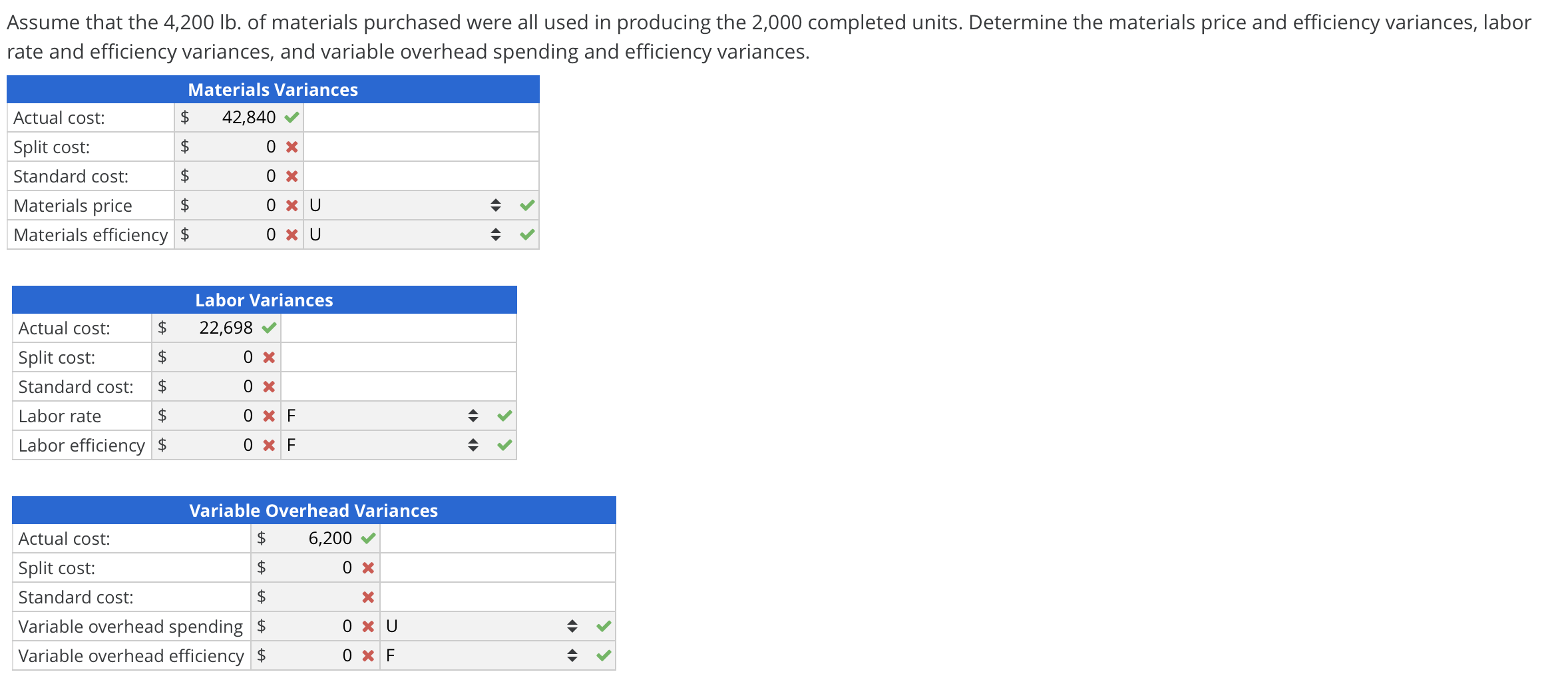

Knowing that variable manufacturing costs were $181,500 over budget is helpful, but it doesn’t isolate the production issue or issues. Therefore, the next step is to individually analyze each component of variable manufacturing costs. The total variable manufacturing costs variance is separated into direct materials variances, direct labor variances, and variable manufacturing overhead variances.

Managerial Accounting

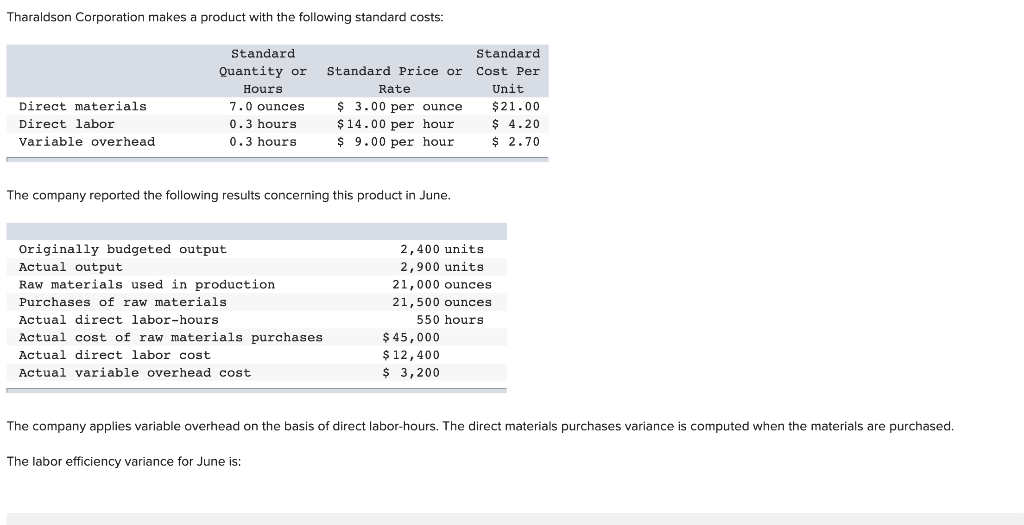

The template provided in Exhibit 8-3 can be used to compute the total direct material variance, direct material quantity variance, and direct material price variance. The standard and actual amounts for direct materials quantities, prices, and totals are calculated in the top section of the direct materials variance template. All standard cost variances are calculated using the actual production quantity as the cost driver. The standard and actual amounts for direct labor hours, rates, and totals are calculated in the top section of the direct labor variance template. Once the top section is complete, the amounts from the top section can be plugged into the formulas to compute the direct labor efficiency (quantity) and rate (price) variances.

Direct labor efficiency variance

The focus of this section is variable manufacturing overhead since it has both a quantity and price standard. Materials usage variance Because the standard quantity of materials used in making a product is largely a matter of physical requirements or product specifications, usually the engineering department sets it. But if the quality of materials used varies with price, the accounting and purchasing departments may perform special studies to find the right quality. Direct materials are those materials that can be directly traced to the manufacturing of the product. Some examples of direct materials for different industries are shown in Table 4.2. In order to respond quickly to production needs, companies need raw materials inventory on hand.

Total direct labor variance

The primary focus on costs allows some leeway in recording amounts because the accountant assigns the costs. When jobs are billed on a cost-plus-fee basis, management may be tempted to overcharge the cost of the job. Cost-based contracts may include a guaranteed maximum, time and materials, or cost reimbursable contract. The training company may charge for the hours worked by instructors in preparation and delivery of the course, plus a fee for the course materials. In this case, the actual quantity of materials used is 0.20 pounds, the standard price per unit of materials is $7.00, and the standard quantity used is 0.25 pounds.

This is a favorable outcome because the actual quantity of materials used was less than the standard quantity expected at the actual production output level. As a result of this favorable outcome information, the company may consider continuing operations as they exist, or could change future budget projections to reflect higher profit margins, among other things. The producer must be aware that the difference between what it expects to happen and what actually happens will affect all of the goods produced using these particular materials. Therefore, the sooner management is aware of a problem, the sooner they can fix it. For that reason, the material price variance is computed at the time of purchase and not when the material is used in production. Labor rate variance The labor rate variance occurs when the average rate of pay is higher or lower than the standard cost to produce a product or complete a process.

Direct Materials Quantity Variance

- Nails are often used in furniture production; however, one chair may need 15 nails, whereas another may need 18 nails.

- The typical billboard sign is 14 feet high by 48 feet wide, and Dinosaur Vinyl incurs a vinyl cost of $300 per billboard.

- For example, the electricity needed to run production equipment typically is not easily traced to a particular product or job, yet it is still a cost of production.

- Standard costs are established for all direct materials used in the manufacturing process.

- Favorable rate variances, on the other hand, could be caused by using less-skilled, cheaper labor in the production process.

For each job, management typically wants to set the price higher than its production cost. Even if management is willing to price the product as a loss leader, they still need to know how much money will be lost on each product. To achieve this, management needs an accounting system that can accurately assign and document the costs for each product. This variance should be investigated to determine if the savings will be ongoing or temporary. The fixed component of manufacturing overhead is comprised of overhead costs that stay the same in total regardless of the quantity produced or another cost driver. For example, rent expense for the production factory is the same every month regardless of how many units are produced in the factory.

Each of the T-accounts traces the movement of the raw materials from inventory to work in process. The vinyl and ink were used first to print the billboard, and then the billboard went to the finishing department for the grommets actual quantity is the actual direct material or direct labor used to manufacture the and frame, which were moved to work in process after the vinyl and ink. The final T-account shows the total cost for the raw materials placed into work in process on April 2 (vinyl and ink) and on April 14 (grommets and wood).

It is important to remember that standards are the planned or projected amounts. Any variance between the standard amounts allowed and actual amounts incurred should be investigated. Standard cost projections are established for the variable and fixed components of manufacturing overhead. Manufacturing overhead includes all costs incurred to manufacture a product that are not direct material or direct labor. The three general categories of costs included in manufacturing processes are direct materials, direct labor, and overhead.

Their costs are assigned to the product as part of manufacturing overhead as indirect materials. Traditional billboards with the design printed on vinyl include direct materials of vinyl and printing ink, plus the framing materials, which consist of wood and grommets. The typical billboard sign is 14 feet high by 48 feet wide, and Dinosaur Vinyl incurs a vinyl cost of $300 per billboard. When a company makes a product and compares the actual materials cost to the standard materials cost, the result is the total direct materials cost variance. A cost driver, typically the production units, drives the variable component of manufacturing overhead. As with any variable cost, the per unit cost is constant, but the total cost depends on the quantity produced or another cost driver.

The expense recognition principle also applies to manufacturing overhead costs. The manufacturing overhead is an expense of production, even though the company is unable to trace the costs directly to each specific job. For example, the electricity needed to run production equipment typically is not easily traced to a particular product or job, yet it is still a cost of production. As a cost of production, the electricity—one type of manufacturing overhead—becomes a cost of the product and part of inventory costs until the product or job is sold. Fortunately, the accounting system keeps track of the manufacturing overhead, which is then applied to each individual job in the overhead allocation process. Some items are more difficult to measure per unit, such as adhesives and other materials not directly traceable to the final product.

Indirect material costs are derived from the goods not directly traced to the finished product, like the sign adhesive in the Dinosaur Vinyl example. Tracking the exact amount of adhesive used would be difficult, time consuming, and expensive, so it makes more sense to classify this cost as an indirect material. Standards are cost or revenue targets used to make financial projections and evaluate performance. For example, if the cost formula for supplies is $3 per unit ($3Q), it is also considered the standard cost for supplies. Managers can use the standard cost formula to make projections about supplies expense or to evaluate the actual amount spent on supplies.